The Plight of Whistleblowers: Reaping Rewards or Getting Benched

In May 2007, Bradley C. Birkenfeld, a former private-banking executive working for UBS, approached U.S. authorities to report illegal practices UBS was performing for the purpose of aiding its clients avoid paying taxes. Birkenfeld had first attempted to report his concerns internally within UBS, a Swiss banking giant that, at the time, managed some $20 billion worth of assets for American clients alone. After his concerns were dismissed by UBS’s compliance office, Birkenfeld decided to become a government informant. As a result of his cooperation and insider knowledge of the bank’s practices, the United States eventually fined UBS an unprecedented $780 million dollars; in addition, it forced UBS to turn over account information on more than 4,500 of its American clients. This latter agreement dealt a serious blow to banking secrecy, one of the most attracting features for many European tax havens, including Switzerland, Germany, and Lichtenstein.

For his part, Birkenfeld admitted to providing his clients with advice and information on how to avoid paying taxes on U.S. securities. Perhaps one of the most famous of his client was real estate developer mogul billionaire Igor Olenicoff, who eventually pleaded guilty to felony of tax avoidance on approximately $200 million he had hidden in offshore accounts and settled with the U.S. by paying some $52 million to the Internal Revenue Service (IRS) in back taxes (incidentally, at the time of this writing, Olenicoff was the only U.S. billionaire to have been mentioned in the infamous Panama Papers). While wrongdoing for providing financial advice can be problematic to prove, Birkenfeld also admitted to other illegal practices. For Olenicoff himself, Birkenfeld used illicit money to purchase diamonds in Europe and smuggled them into California in a toothpaste tube, all in an effort to assist Olenicoff hide the value of its assets. Birkenfeld was eventually charged and found guilty of one single fraud conspiracy count and sentenced to 40 months in prison, a sentence that he began serving in January 2010.

Then, in September of 2012, the IRS announced that due to his valuable contribution on the investigation into UBS and offshore banking secrecy, Birkenfeld would be rewarded $104 million.

The largest payout ever given to an informant, the $104 million awarded to Birkenfeld were part of the IRS’s whistleblower program, which rewards informants up to 30 percent of collected funds and fines from pursued claims. Around the time of the award, the IRS was seeking to shrink potential whistleblowers’ payout, which drew fierce criticism from a number of lawmakers. The IRS program, which was revamped in 2006 to offer higher rewards and incentives, was created to encourage informants to come forward with allegations of potential wrongdoings in an effort to help the agency recover an estimated $100 billion a year of underpaid taxes. And while large informant payouts are extremely rare, there are several federal whistleblower programs that offer incentives to citizens who wish to provide information to the government.

Along with the IRS, the Securities Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are three of the largest whistleblower programs in the federal government. Each of them, however, operates differently and under their own rules, which has resulted in initiatives that call for more comprehensive guidelines. All three of these programs, for example, offer discretionary percentage rewards for whistleblowers for recoveries generated, which can range form 10 percent to 30 percent, as opposed to a mandatory set percentage sum. This means that whistleblowers, who may already face professional and financial risks by coming forward with information, do not necessarily have a clear financial upside that can outweigh the perils, a shortcoming that may deter potential informants. Payouts are also shared among the informants who are eligible for reward. In the case of Birkenfeld, for example, he received the entire payout. Meanwhile, in December of 2000, the Justice Department awarded $100 million to two whistleblowers after they informed the FBI that the healthcare giant HCA was regularly overbilling Medicare. The two shared the total award between them.

The CFTC is the only agency that offers complete anonymity to whistleblowers. Informants can remain anonymous throughout the entire process, even to the government. Their identities are disclosed to the agency only after they have qualified for an award. Whistleblowers, who are defined by the CFTC as anyone who submitted a tip that led the agency to collect monetary sanctions, must submit a form to the CFTC requesting an award after the agency has posted notices of obtained final judgments of no less that $1 million in recovery. The CFTC then decides how much of a monetary reward, if any, a tip was worth. The IRS on the other hand, must collect a minimum of $2 million in recovered assets from a claim before a whistleblower can be eligible for an award.

Besides the CFTC’s, all other programs require that whistleblowers identify themselves at the time of submitting a tip. The IRS, SEC, and CFTC programs also decide if they want to pursue a claim. If they decide not to, the whistleblower’s attempt to collect a reward simply ends. Moreover, the whistleblower has no legal authority to pursue a claim on their own, or at least not conduct an investigation as private citizens.

Through the False Claims Act, which was enacted long ago under President Lincoln during the American Civil War, private citizens can pursue a claim in court through lawsuits against corporations (historically federal contractors) with basically the same authority as the government would, though the risks of doing so are far greater than through a whistleblower program.

In 2009, the U.S. government awarded 10 citizens a sum of $102 million for their lawsuit against pharmaceutical giant Pfizer, which helped uncover aggressive marketing transgressions and fraud. Pfizer ended up settling with the U.S. government and paid the largest health fraud penalty is U.S. history, a fine of $2.3 billion. For the 10 citizens that received the award, one of them alone, original whistleblower John Kopchinski, received a total of $51.5 million. As recently as February of this year, Pfizer once again ended a whistleblower lawsuit by paying the U.S. government a settlement of $784 million. The two whistleblowers that brought the lawsuit to the pharmaceutical will share a reward of $59 million.

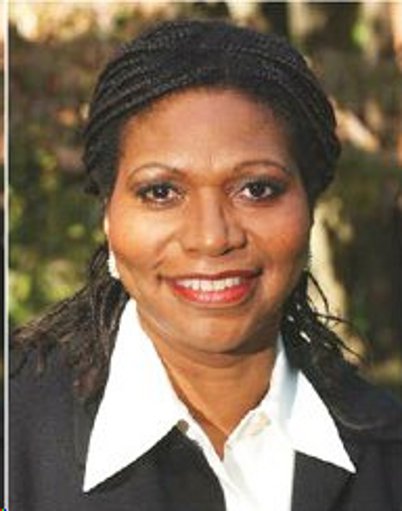

Some whistleblower programs, however, have come under scrutiny for underperformance and poor treatment of informants. In 1996, Marsha Coleman-Adebayo was working as an Environmental Protections Agency (EPA) representative to the Gore-Mbeki commission, which was created between the U.S. and South African governments to help improve the lives of South African citizens and to help in the transition of the newly formed government under Nelson Mandela. During her time in South Africa, Coleman-Adebayo encountered a number of problematic practices at the hands of an American company that was ignoring complaints placed by its South African laborers. She raised her concerns with the EPA.

Coleman-Adebayo claimed that her supervisors told her to “shut up” about the problem and faced death and rape threats. She filed a suit against the EPA for discrimination, which she says began when she blew the whistle on the South African-American affairs, under the Whistleblower Protection Act of 1989. She eventually won the case in 2000, which resulted two years later in congress passing the Notification and Federal Employee Antidiscrimination and Retaliation Act (No FEAR Act), which requires that federal agencies be accountable for violations of antidiscrimination and whistleblower protection laws.

Earlier this year, the EPA came under heavy fire again after the Flint water crisis broke out. Miguel del Toral began investigating the water in Flint in 2015 working as a regulations manager for the EPA. The Flint water crisis began gaining national notoriety due, in part, to a memo del Toral wrote in which he clearly outlined the water woes afflicting Flint. The memo was circulated internally within the EPA and was never meant to be published, until the American Civil Liberties Union leaked a copy it obtained from a Flint resident whose water del Toral had tested. This was as early as July of 2015. The memo marked a key point in the Flint saga because it shows that EPA officials were made aware of the looming public health risk at Flint but downplayed its significance.

Upon sharing his findings with the EPA, del Toral claimed that he was mistreated, silenced, and discredited by his supervisors, and some congressional investigators agree. The House Oversight and Government Reform Committee publicized a number of emails del Toro had written in which he complained about his treatment at the hands of the EPA. In the summer of 2015, emails released by the House Oversight Committee show that del Toral disagreed with the EPA’s decision not to impose the city of Flint with a violation for failing to treat the water correctly. It wasn’t until January of this year when the EPA finally issued an emergency order.

At a congressional hearing, Susan Hedman, the supervisor for EPA Region 5 at the time and who has since resigned, denied that the agency was retaliating against del Toral, who had been raising concerns about lead levels in the Flint water since at least April of 2015 and had become an accidental whistleblower of sorts, at least as defined by the Whistleblower Protection Act of 1989. Hedman called del Toral “a hero” during a congressional hearing. Del Toral has not sought for damages or compensation for his mistreatment at the hands of the EPA.

Though whistleblower programs have been around for some time, they may still feel like experiments to figure out what works best. And while the rewards reaped by whistleblowers can be large and enticing, that outcome remains a rare occurrence.

Since its revamping in 2006, for example, up until Birkenfeld’s reward six years later, the IRS’s whistleblower program had only paid out one known award to an informant. And despite the Dept. of Justice collecting over $26 billion dollars from 2009 (when the act was amended) through last year off the False Claim Acts alone, the number of whistleblower claims has been reducing. Still, the theory and practice of whistleblower programs seem to be in an upward trend. At least two states (Indiana and Utah) now have their own state-level whistleblower programs to help crack down on securities fraud. Whereas they will be as successful—or arguably as ineffective—as their federal counterparts, remains to be seen.

Author Bio:

Angelo Franco is Highbrow Magazine’s chief features writer.

For Highbrow Magazine